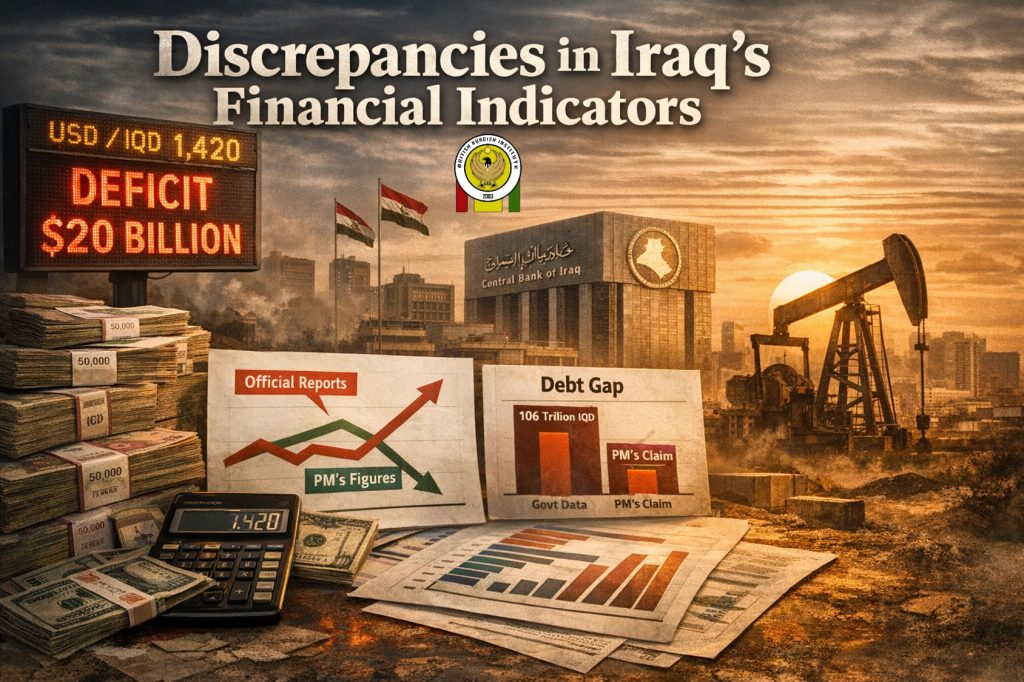

Iraq’s fiscal outlook has recently come under renewed scrutiny following statements made by Prime Minister Mohammed Shia’ al-Sudani in an interview with the Iraqi News Agency (INA). While the Prime Minister presented updated figures on public debt and currency exchange rates, these numbers differ substantially from data published by the Ministry of Finance, the Central Bank of Iraq (CBI), and international institutions—raising serious concerns about transparency and data reliability.

Contradictory Public Debt Figures

According to Prime Minister Sudani, Iraq’s domestic public debt stands at 34 trillion Iraqi dinars, while external debt amounts to 13 trillion dinars, bringing total public debt to 47 trillion dinars. He also cited a black-market exchange rate of 1,420 dinars per US dollar.

However, official data tell a very different story. Figures released by the Ministry of Finance and the CBI indicate that, by the end of June 2025, Iraq’s total public debt had reached approximately 106 trillion dinars, including 87 trillion dinars in domestic debt and 18.7 trillion dinars in external debt. The gap between these figures—nearly 60 trillion dinars—raises fundamental questions about fiscal reporting accuracy and institutional coordination.

Public Sector Expansion vs. Private Investment

Beyond debt discrepancies, Iraq faces a growing imbalance between public-sector employment and private-sector investment. While cumulative private-sector investment has surpassed $100 billion, the public workforce has expanded at an unprecedented pace.

Under the three-year federal budget, total public-sector employment (including the Kurdistan Region) was projected at 4.07 million employees. Yet within just two years and five months, this figure has risen to approximately 4.55 million, meaning nearly 500,000 new employees have been added to government payrolls. Notably, about one-fifth of the current public-sector workforce has been hired within the past two and a half years.

This rapid expansion calls into question the effectiveness of private investment in generating sustainable employment and reducing pressure on public finances.

Debt Trends and Fiscal Sustainability

Although the Ministry of Finance’s public debt dashboard—covering the period from 2010 to June 2025—has recently been removed from its official website, previously published data reveal troubling trends. As of June 2025, Iraq’s external debt stood at 18.79 trillion dinars, while domestic debt reached 87.38 trillion dinars.

CBI data further show that domestic public debt rose sharply from 73.25 trillion dinars to 85.54 trillion dinars within a short period. This acceleration significantly increases future fiscal risks, particularly in the absence of meaningful public finance reforms.

Revenue Dependence on Oil and a Widening Deficit

Despite repeated calls for diversification, Iraq’s fiscal structure remains overwhelmingly dependent on oil revenues. During the first nine months of the year, total government revenues reached 91.1 trillion dinars, of which 81.7 trillion dinars—nearly 90 percent—came from oil exports.

Over the same period, public expenditures totaled 99.97 trillion dinars, with 85.4 trillion dinars allocated to operational spending and only 14.4 trillion dinars directed toward investment. As a result, the fiscal deficit exceeded 8.8 trillion dinars, compared to 9.7 trillion dinars during the same period last year.

Based on projected spending and oil revenue estimates, Iraq’s annual fiscal deficit is expected to exceed $20 billion, implying that public debt will continue to rise unless substantial fiscal adjustments are implemented.

Energy Subsidies and Fiscal Pressure

According to the International Energy Agency (IEA), Iraq ranked fourth globally in energy-related fiscal subsidies in 2024. Average subsidies reached 27 percent, equivalent to $317 per capita, accounting for approximately 5.3 percent of GDP growth.

Total spending on oil, gas, and electricity subsidies amounted to $14.7 billion, with $8.3 billion allocated to oil products and $4.47 billion to electricity subsidies. Additional measures—such as providing free diesel fuel to private electricity generators during summer—further increased subsidy costs instead of curbing them.

The IEA warns that continued fossil-fuel subsidies distort market signals, increase fiscal burdens, and undermine environmental sustainability, urging countries to phase them out as a priority policy measure.

Conclusion: A Crisis of Data and Direction

Iraq’s fiscal challenges are not solely the result of high spending or oil price volatility, but also of persistent inconsistencies in official financial data. Discrepancies amounting to trillions of dinars and billions of dollars undermine transparency, weaken budget planning, and obscure the country’s long-term economic direction.

With rising subsidies, a growing fiscal deficit, and conflicting reports on debt and revenues, Iraq faces urgent questions:

How can public debt be reduced under current conditions?

And why do official figures from Iraqi institutions continue to diverge so widely?

Without reliable, consolidated data and a coherent fiscal strategy, Iraq’s economic outlook will remain fragile.