Quick summary for search results:

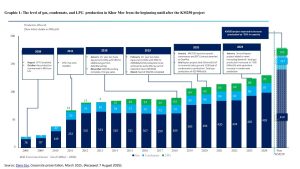

With the KM250 expansion at the Khor Mor field entering final pre-production tests and the Chemchemal field ramping up, the Kurdistan Region of Iraq (KRI) is poised to lift total gas output to ~1.025 billion cubic feet per day (bcf/d) in 2025—putting it within striking distance of Iraq’s nationwide production.

Key numbers at a glance

-

KM250 (Khor Mor): adds +250 MMcf/d, taking Khor Mor’s operated gas to ~540 MMcf/d initially and lifting total field output by ~50% across gas, condensate, and LPG.

-

Chemchemal (start-up phase): targeted at ~75 MMcf/d.

-

KRI total (near-term mix):

-

Khor Mor + Chemchemal: ~865 MMcf/d

-

Khurmala (KAR Group): 120–130 MMcf/d

-

Sarqala (WesternZagros & Gazprom): 10–15 MMcf/d

-

DNO gas: ~20 MMcf/d (currently reinjected)

-

KRI total: ≈1.025 bcf/d

-

-

Iraq total (OPEC/EI): ≈1.15 bcf/d.

-

KRI reserves: >33 tcf (≈26 tcf non-associated + >7 tcf associated).

-

Iraq reserves (EIA): ≈131 tcf.

What KM250 changes

Dana Gas and partners are conducting the final “pressure testing with nitrogen” step before switching to production at KM250. Once online, Khor Mor’s gas, condensate, and LPG volumes rise by around 50%. Company guidance indicates end-year output around ~810 MMcf/d of dry gas, ~127 MMcf/d of condensate, and ~105 MMcf/d of LPG from Khor Mor’s streams.

Use this for the article image alt text:

“Khor Mor KM250 production growth chart showing gas, condensate and LPG increases.”

How the KRI gets past the 1 bcf/d mark

-

Ramp Khor Mor (KM250) and bring Chemchemal onstream (~865 MMcf/d combined).

-

Add ongoing supply from Khurmala (KAR Group, 120–130 MMcf/d).

-

Include Sarqala (10–15 MMcf/d) and DNO gas used for oil operations (~20 MMcf/d).

Bottom line: The KRI crosses ~1.025 bcf/d—nearly the same scale as Iraq’s total gas output today.

Why this matters for Iraq’s energy balance

-

Lower imports: Extra KRI gas could reduce Iraq’s dependence on Iranian gas and Turkish electricity.

-

Two monetization paths: (1) Sell gas to federal Iraq for power plants (as previously explored for sites like Kirkuk); or (2) Sell electricity generated in the KRI—where installed and planned infrastructure can reach up to ~8,000 MW, enabling 2–3× higher power sales to Iraq.

-

Closing the supply gap: EI estimates Iraq’s 2024 gas supply deficit at ~750 MMcf/d, leaving room for KRI molecules or power.

Context: reserves, history, and flaring

-

Despite holding about one-quarter (≈25%) of Iraq’s gas reserves, the KRI is approaching Iraq-wide production levels thanks to rapid field development and reduced flaring.

-

Iraq has produced gas since 1970 (0.07 bcf/d then; 1.15 bcf/d in 2024).

-

KRI began in 2008 (78 MMcf/d then; ~0.7 bcf/d last year; >1 bcf/d expected by end-2025).

-

Tackling associated gas flaring remains critical nationwide; some southern fields still rank among the world’s highest for flared volumes.

Khor Mor in a regional context

With KM250, Khor Mor sits alongside the Khazzan (Oman), Zohr (Egypt), and Leviathan (East Med) developments as one of MENA’s major gas projects—transforming the KRI from a fledgling producer into a meaningful regional supplier.

Contracts, routes, and the road ahead

-

In May, the KRG signed investment deals with HKN and WesternZagros for Miran and Topkhana. Progress there would push KRI output beyond Iraq’s total in the coming years.

-

A 2019 gas sales agreement exists between Dana Gas and the KRG for KM250 volumes. Talks last year about selling gas to Iraq were paused over security concerns and drone attacks. With an extra 250 MMcf/d imminent, the key question is whether sales proceed directly with Baghdad or via tripartite KRG–Baghdad–operator arrangements.

-

Gas projects are capital-intensive and security-sensitive; Khor Mor’s expansion itself saw ~three years of delay due to security risks. Sustained stability will determine how fast the KRI can commercialize new volumes.

Fast comparison

| Metric | Kurdistan Region | Iraq (nationwide) |

|---|---|---|

| Proven gas reserves | >33 tcf | ~131 tcf |

| 2025 output (est.) | ~1.025 bcf/d | ~1.15 bcf/d |

| Gas start year | 2008 | 1970 |

| Flagship project | Khor Mor – KM250 | Southern associated gas & processing |

Conclusion

If KM250 ramps as planned and Chemchemal contributes on schedule, the KRI crosses 1 bcf/d in 2025. That milestone would reset Iraq’s energy math, open new gas-to-power and export options, and position the Kurdistan Region as an emerging supplier in the energy-transition era—provided security and commercial frameworks keep pace.

Q1: When will KM250 start adding volumes?

A: Final nitrogen pressure tests are underway now; first gas follows, lifting Khor Mor’s output by ~250 MMcf/d.

Q2: How much can KRI sell to Iraq?

A: EI estimates a ~750 MMcf/d national shortfall. Volumes can be sold as gas or converted to power for sale into the grid.

Q3: What could push output even higher?

A: Progress at Miran and Topkhana, continued flaring reduction, and stable security conditions.